capital gains tax increase 2021 retroactive

Signed 5 August 1997. Biden has proposed raising the top tax rate on capital gains to 434 percent from 238 percent for households with income over 1 million.

Pe Deals Surge As Higher Us Capital Gains Tax Looms Pe Spac Involvement Grows S P Global Market Intelligence

President Bidens blockbuster 6 trillion budget assumes that his proposed capital-gains tax hike took effect in April according to the Wall Street Journal.

. The effective date for the capital-gains tax rate. Tax brackets change slightly from year to year as the cost of living increases. With this retroactive income tax hike the White.

The table also shows the inclusion Eligible. One of the big surprises included in President Joe Bidens first budget is the retroactive application of the near 100 capital gains tax hike. Proposed Biden Retroactive Capital Gains Tax Could Be Challenged on Constitutional Grounds.

My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary. The long term capital gain tax is graduated 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income over 441451 in some cases add the 38 Obamacare tax.

Top earners may pay up to 434 on long-term capital gains including the 38 Net Investment Income Tax. For 2021 individual taxpayers will not pay capital gains tax if. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

The later in the year that a Democratic tax bill if any is passed the less likely it will have any retroactive effect. Bidens Proposed Retroactive Capital Gains Tax Increase Jun 14 2021 Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax rate to help pay for the American Families Plan. The Basics For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates.

Appendix Top 2020 marginal tax rates for capital gains and dividends The following table illustrates the current top marginal tax rate on capital gains by provinceterritory as well as the potential top marginal tax rate on capital gains if the inclusion rate increases to 66 2 3 or 75. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. What is the income level for capital gains tax.

As expected the Presidents proposal would increase the top marginal ordinary income tax rate from 37 to 396 and would apply ordinary income tax rates to capital gains. AUGUST 11 2021 BYJOE BISHOP-HENCHMAN. Below you can find the 2022 short-term capital gains tax brackets.

June 16 2021 1108 AM PDT Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective starting in April 2021 that. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis.

Retroactive Tax Increase. President Joe Biden unveiled a budget proposal Friday calling for a 396 top capital gains tax rate matching previous outlines to help pay for the American Families Plan. Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of the year would have been greater.

If this were to happen it may not only. Having resolved the infrastructure bill Congress now begins debate and consideration of the budget through a reconciliation process since that can be passed with 50 votes bypassing the normal process that subjects. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all sales on or after April 2021.

As a result the short-term capital gains rates for 2022 look slightly different than those for 2021. President Joe Bidens proposal to raise the capital-gains tax rate to 396 from 20 for those earning 1 million or more was first announced April 28 as part of the administrations American. However if John waits a year and a day to sell he pays 0 of the capital gain.

The later in the year that a. Earlier this year President Biden proposed a 2022 budget for the federal government along with a Greenbook explaining corresponding proposed changes to the tax code. Reduced the maximum capital gains rate from 28 percent to 20 percent.

Effective for taxable years ending after 6 May 1997 ie for the full calendar year in. The top rate for 2021. The capital gains tax.

If John sells an asset that has a short-term capital gain of 1000 his tax liability will increase by an additional 120 ie 12 x 1000.

What Business Owners Need To Know About The Proposed Capital Gains Tax Roebling Capital Partners

Surviving The Last Minute Tax Rush Benefitspro

Retroactive Tax Legislation And Gift Planning In 2021 New Jersey Law Journal

The New Method Of Capital Gains Calculation

2021 Federal Budget Tax Increases To Come Welch Llp

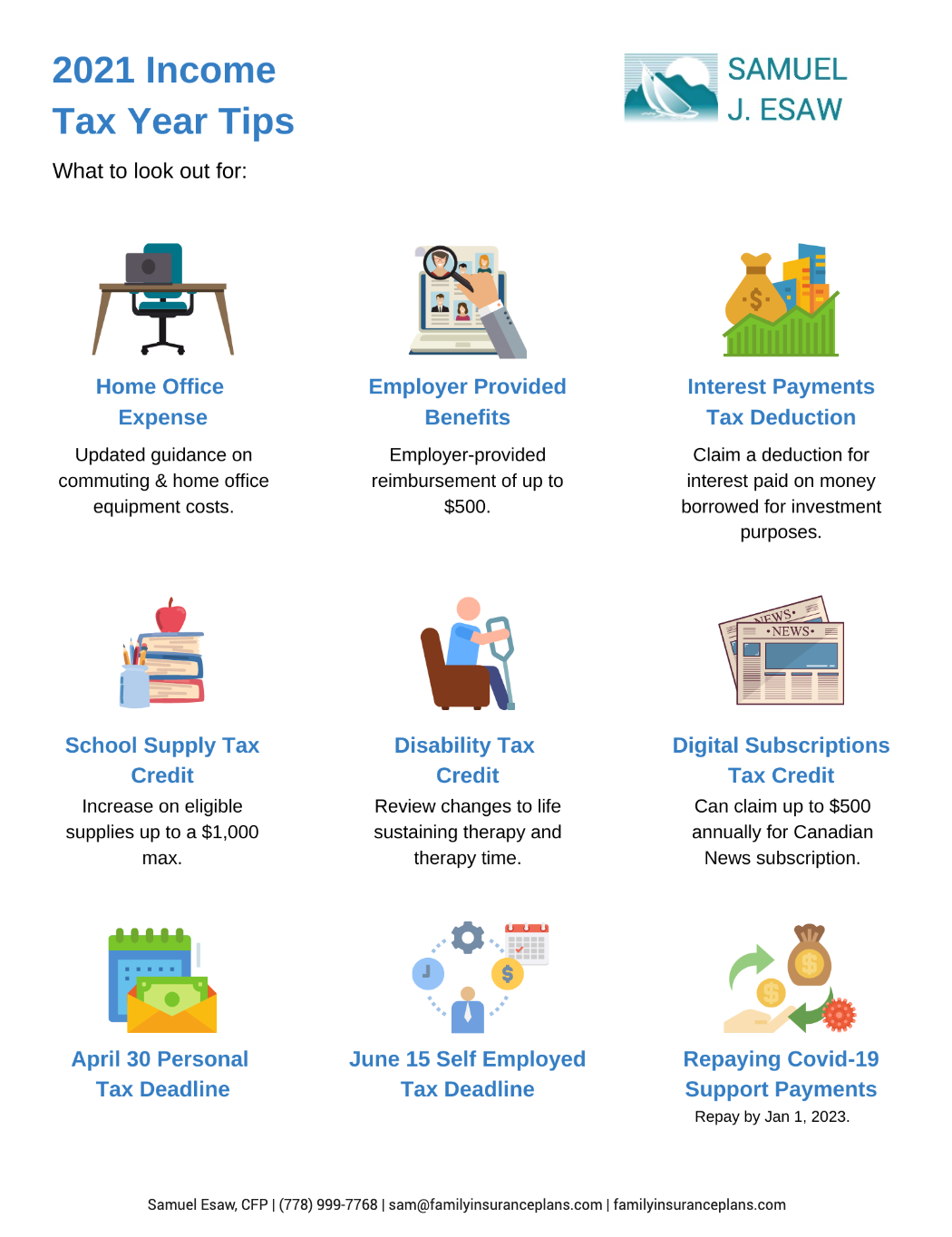

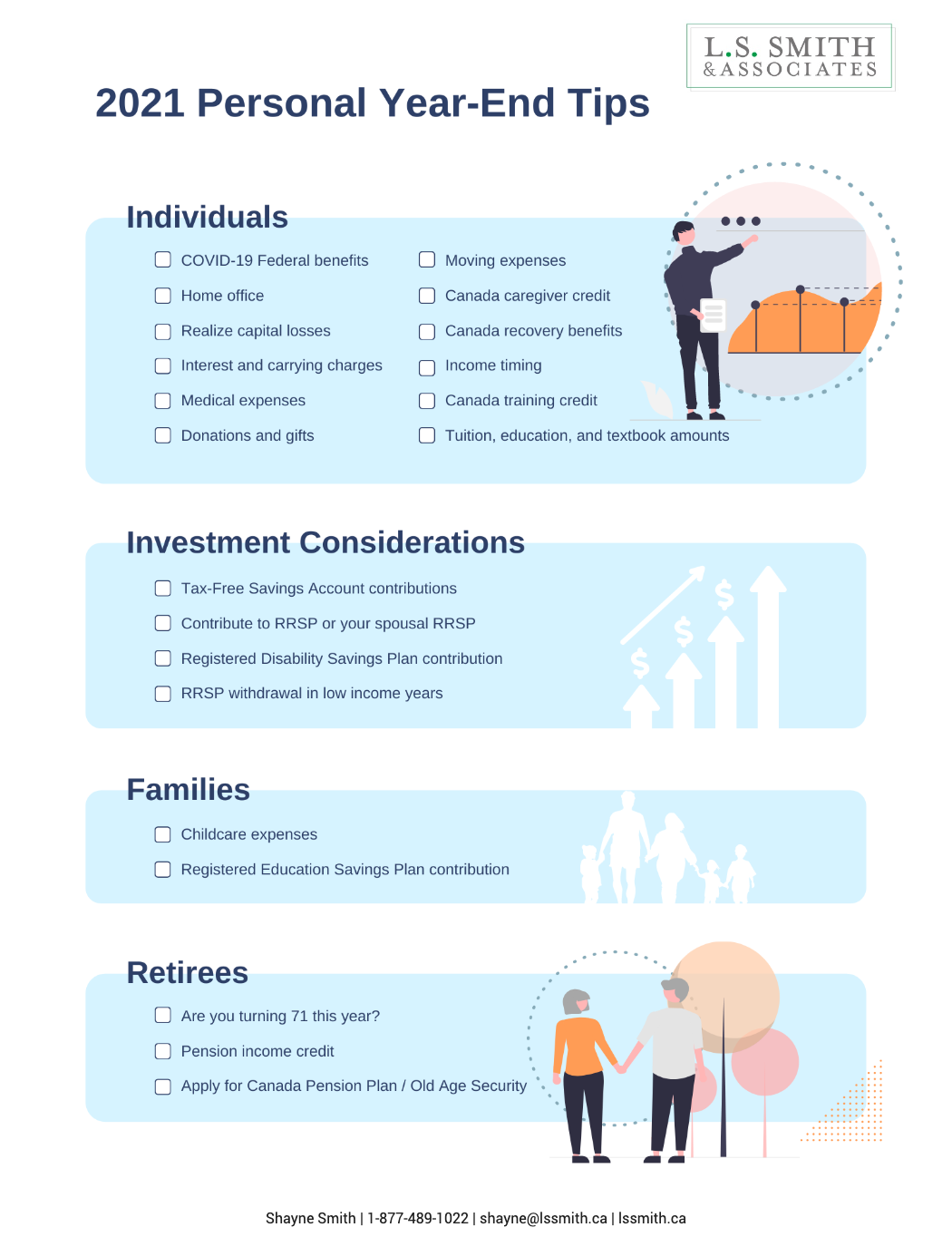

2021 Personal Year End Tax Tips Samuel J Esaw

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

The Treasury Green Book Of Biden Proposed Tax Changes Accountant In Orem Salt Lake City Ut Squire Company Pc

Capital Gains Tax Strategies How To Protect Your Assets And Stay On Track For Retirement Cambridge Trust

Governor Brown S Tax Proposal And The Folly Of California S Income Tax Tax Foundation

2021 Personal Year End Tax Tips L S Smith And Associates

Tax Reform News Alert Biden Administration Proposes To Retroactively Raise Capital Gains Taxes Legal 1031

Will Congress Reshape The Tax Landscape Bernstein

Taxmatters Ey December 2021 Ey Canada